- #How to file extension for business tax return in nj professional#

- #How to file extension for business tax return in nj free#

If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. We will not represent you before the IRS or state agency or provide legal advice.

#How to file extension for business tax return in nj professional#

#How to file extension for business tax return in nj free#

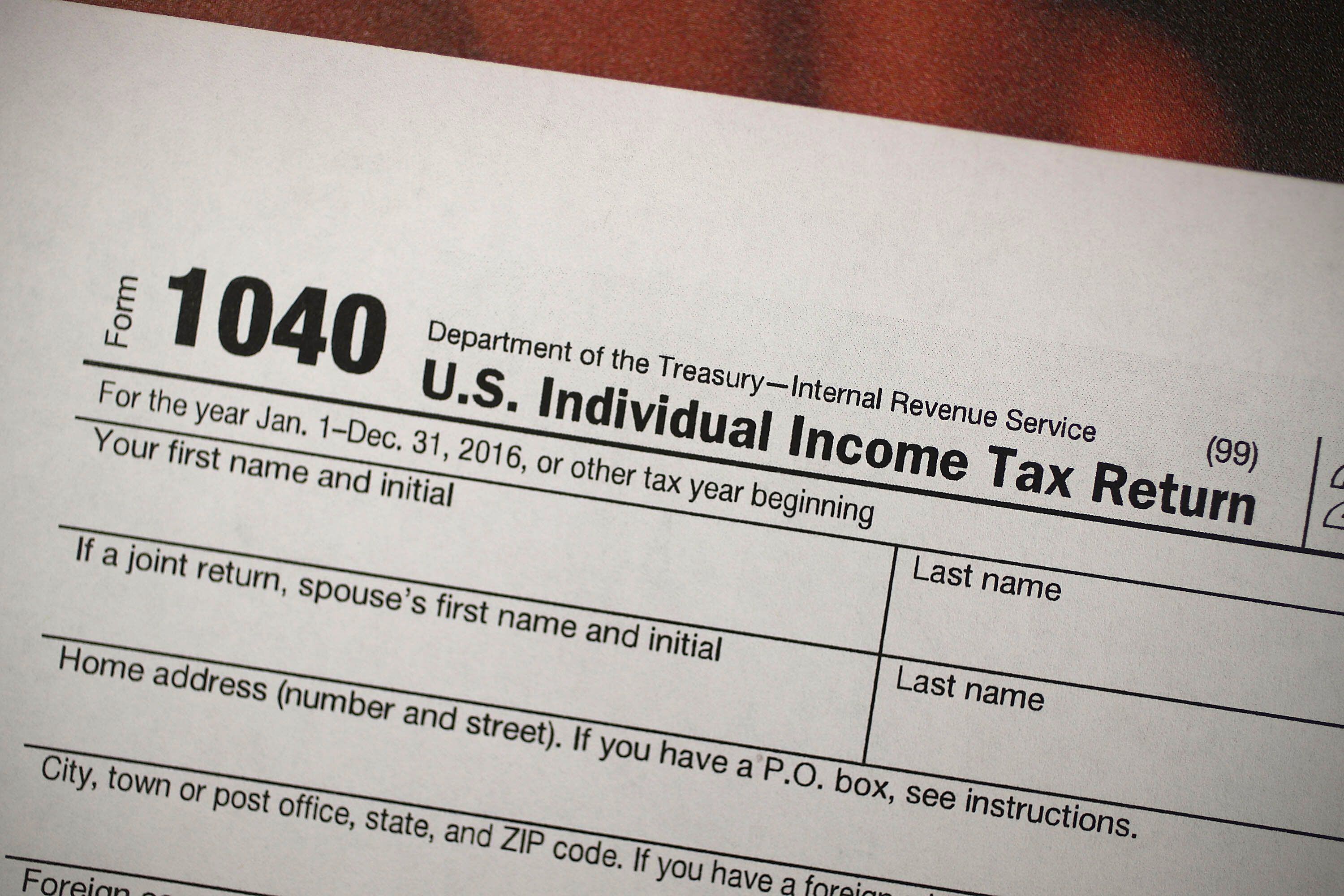

(TurboTax Online Free Edition customers are entitled to payment of $30.) Limitations apply. Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back: If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the applicable TurboTax federal and/or state purchase price paid.100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest.Limited interest and dividend income reported on a 1099-INT or 1099-DIV.A simple tax return is Form 1040 only (without any additional schedules). TurboTax Free Edition: $0 Federal + $0 State + $0 To File offer is available for simple tax returns only with TurboTax Free Edition.The due date for your calendar-year 2021 S corporation return will be extended until September 15, 2022. If you think you may need more time to prepare the S corporation's return, you should file for an extension using Form 7004.If the S corporation fails to file its 2021 return (including a Schedule K-1 to each shareholder) on time, it may also owe an additional penalty of $195 per shareholder per month for each month the return is late, up to a maximum of 12 months.If you do not file or extend the S corporation's return by March 15 (unless another date due to holidays or weekend), it may owe a penalty of 5% of the unpaid tax for each month the return is late, up to a maximum of 25% of the unpaid tax.If the S corporation does not pay all of the tax by that date, it may owe a penalty of 0.5% of the unpaid tax for each month the tax is not paid, up to a maximum of 25% of the unpaid tax.In the event your calendar-year S corporation owes taxes for 2021, you'll have to pay interest on the amount you fail to pay by March 15.

An S corporation must provide a Schedule K-1 to all shareholders, detailing their share of the corporation's income and deductions for the tax year.

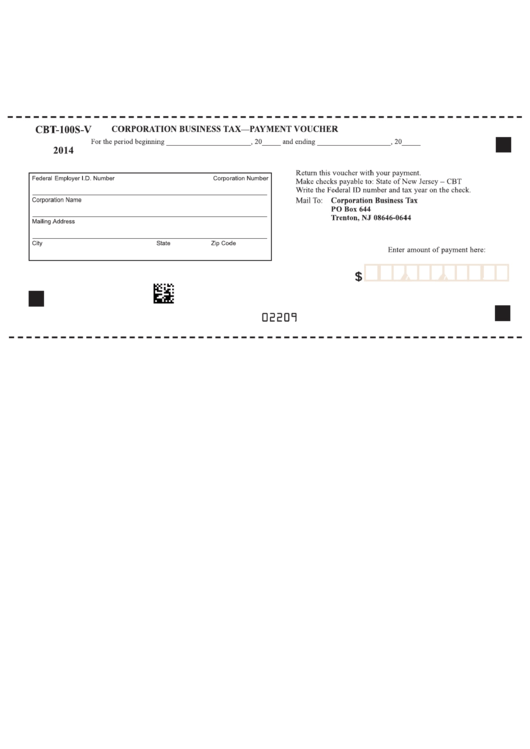

However, if your S corporation was once a C corporation, it may owe a corporate-level tax in certain limited situations. If your business has always been an S corporation, it is effectively treated as an extension of the shareholders for many tax purposes and will generally not owe any tax itself. With fiscal years ending June 30, 2027, the filing deadline moves to October 15th (the 15th day of the 4th month following the end of the fiscal year) and the extended deadline moves to March 15th (six months after the first deadline). This exception applies for fiscal years ending through June 30, 2026. For example, the due date for the tax return of a corporation for the fiscal year ending Mais July 15, 2021.Īn exception to this - corporations with a fiscal year from July 1 to June 30, the initial deadline will remain September 15th (15th day of the 3rd month following the end of the fiscal year) and the extension deadline remains February 15 (five months after the first deadline). In the event you are a fiscal year taxpayer, please adjust your due dates based on the information provided above.

We assume your business entity is a calendar year taxpayer.

The IRS may hit your business with costly penalty and interest charges if you underestimate your taxes, file your return late, or do not furnish certain information by the due date.

0 kommentar(er)

0 kommentar(er)